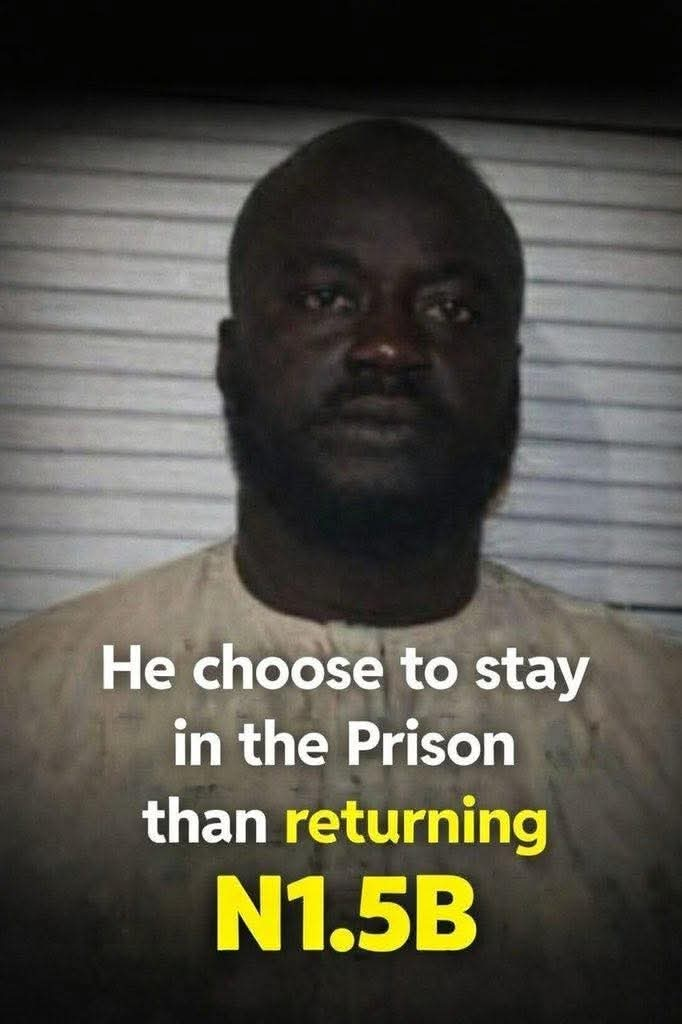

A First Bank customer, Ojo Eghosa Kingsley, has sparked controversy after openly choosing to serve a prison sentence rather than refund ₦272.25 million remaining from a ₦1.5 billion credit mistakenly paid into his account.

Kingsley was accused of diverting the funds for personal use after First Bank erroneously credited his account with ₦1.5 billion. According to investigators, the diversion occurred between June and November 2025, during which the funds were moved through multiple accounts and spent.

He was arrested by operatives of the Economic and Financial Crimes Commission (EFCC) in Benin City and was arraigned on January 19, 2026, before the Edo State High Court. He was charged with theft and fraud contrary to the provisions of the Edo State Criminal Law (2022).

Upon the reading of the charges, Kingsley pleaded guilty without hesitation. His counsel appealed to the court for leniency, citing his remorse and willingness to cooperate with authorities.

Delivering judgment, the court sentenced Kingsley to one year imprisonment with an option of a ₦5 million fine. The court also ordered him to refund the outstanding sum of ₦272,252,193.59 to First Bank.

The court was informed that prior to the judgment, the EFCC had recovered ₦802,420,000 from Kingsley’s account and from accounts belonging to his mother and sister. In addition, First Bank successfully reversed transactions amounting to over ₦300 million.

However, in a dramatic twist after the ruling, Kingsley told the court that he preferred to serve the prison sentence rather than refund the remaining ₦272 million, effectively choosing incarceration over repayment.

The case has since generated public debate over financial crimes, accountability, and the consequences of exploiting banking errors.