The Economic and Financial Crimes Commission (EFCC) has launched an investigation into the Edo State Government’s use of Central Bank of Nigeria (CBN) loans, totaling N60 billion, amid allegations of transparency issues ¹. The probe comes just weeks before the outgoing Governor Godwin Obaseki’s administration hands over power to Senator Monday Okpebholo on November 12, 2024.

*Loans Under Scrutiny*

The EFCC is examining three key loans:

– _N1.8 Billion Micro, Small, and Medium Enterprises Development Fund (2017)_: Benefiting over 12,000 entrepreneurs in agriculture, manufacturing, and trade.

– _N5 Billion Agripreneur Program (2019)_: Supporting 1,700 smallholder farmers with poultry and other resources at a 9% interest rate.

– _N18.7 Billion Bridge Finance Facility (2021)_: Sanctioned by President Muhammadu Buhari to aid states in navigating fiscal challenges.

Commissioner for Information Chris Nehikhare claims the EFCC’s intentions go beyond investigation, aiming to “cripple governance” and undermine Obaseki’s administration. Nehikhare asserts that the loan under scrutiny has been repaid and accuses the EFCC of detaining officials to impede the completion of Obaseki’s tenure.

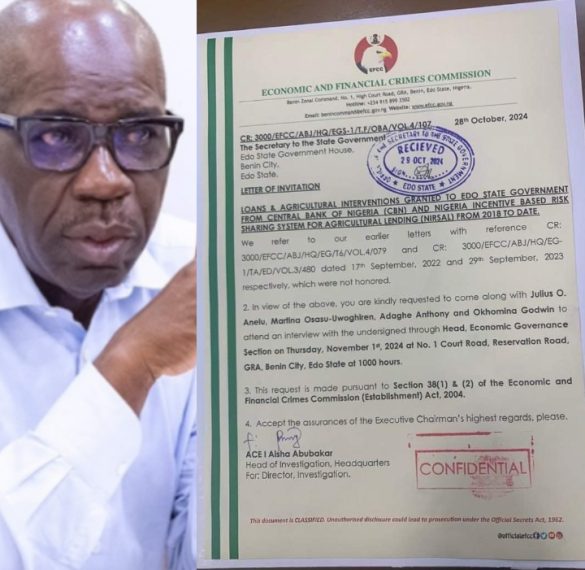

The EFCC summoned the Secretary to the Government and four other officials, including Julius O. Anelu and Martina Osasu-Uwoghiren, for questioning. The agency’s letter, signed by Head of Investigation Aisha Abubakar, cited Sections 38(1) and (2) of the EFCC Act, 2004, emphasizing the probe’s legality.

The investigation’s outcome may impact the future of EFCC-state relations and set a precedent for anti-corruption investigations’ influence on state governance. The Supreme Court is set to hear arguments on the EFCC’s authority to investigate state funds without explicit state consent.