Thousands of Nigerians are reeling in financial shock following the alleged collapse of CBEX, a digital investment platform accused of siphoning off over N1.3 trillion from investors in what appears to be a large-scale Ponzi scheme.

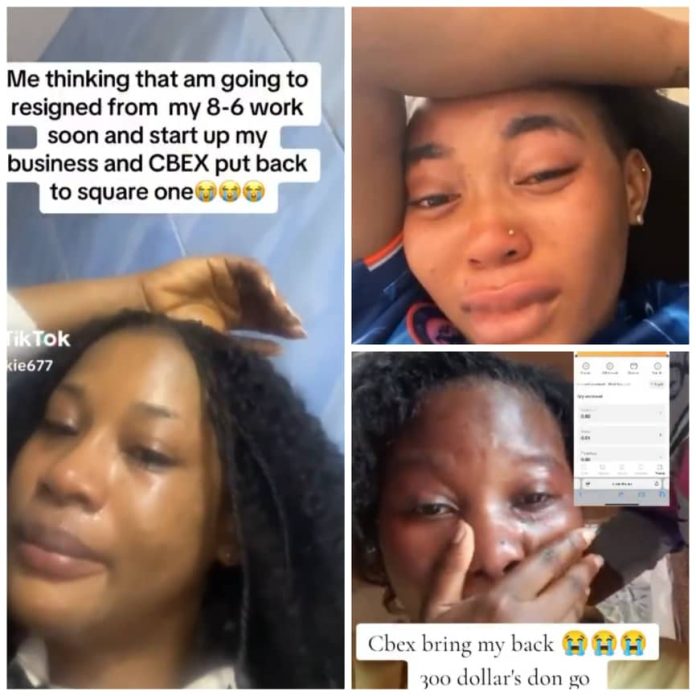

According to Hobnob News Online, distraught investors—many of them women—have been seen in viral videos sobbing uncontrollably after reportedly losing life savings to the now-inaccessible platform.

Trouble began when users started facing issues withdrawing their funds. Soon after, they noticed their account balances had been mysteriously reduced to zero, sparking panic and widespread outrage across social media platforms.

On X (formerly known as Twitter), reactions have been intense. One user, @edoPeekeen, reflected the general sense of despair: “Even people not involved are crying… Nigeria don tire person. You can’t tell who’s telling the truth anymore.”

While many sympathized with victims, others called for better financial education. User @Eskimoh_ posted: “The number one rule of investing: never put in money you can’t afford to lose. Sadly, financial literacy isn’t even taught in schools.”

Some responses, however, were more critical. “Nigerians never learn,” wrote @ricky_chiekezie, suggesting that greed and gullibility continue to fuel such investment scams. Others mocked victims for posting emotional breakdowns online, urging them to exercise discretion and learn from the situation.

For many, the incident is a harsh reminder of the risks associated with high-yield investment platforms, especially those operating outside regulatory frameworks. As @DSegaj put it: “If managing wealth were easy, wealth management firms wouldn’t exist. A good advisor could’ve prevented these losses.”

CBEX had advertised itself as a high-return investment hub, offering users up to 100% returns in just 30 days—an offer too good to be true, as financial experts now warn.

A popular forex broker, @Obobanj, has also been linked to the platform, though no formal charges have been brought. As stories and accusations continue to surface, calls are growing for a thorough investigation.

The Central Bank of Nigeria (CBN) and the Securities and Exchange Commission (SEC) have previously warned the public against unregulated investment schemes promising unrealistic profits. Still, platforms like CBEX keep surfacing, luring in thousands before crashing—often without warning.

Efforts to reach CBEX representatives for comments have been unsuccessful. The full extent of financial losses may not be known for weeks, but for many Nigerians, the damage—both financial and emotional—is already done.