A storm of opposition is brewing in northern Nigeria as political and civic leaders voice their dissatisfaction with President Bola Tinubu’s firm position on the controversial tax reform bills. The leaders, comprising members of the National Assembly, the Northern Elders’ Forum (NEF), and the League of Northern Democrats, accuse the President of bypassing due legislative processes and excluding key stakeholders from consultations.

At the center of the controversy are four proposed tax reform bills submitted to the National Assembly in September 2024. The bills, recommended by the Taiwo Oyedele-led Presidential Committee on Fiscal and Tax Reforms, are aimed at modernizing Nigeria’s tax system, combating corruption, and increasing government revenue. However, critics argue that the reforms, particularly the Nigeria Tax Bill 2024 and the Tax Administration Bill, disproportionately favor specific regions and ignore the broader implications for the country.

Contentious Proposals Spark Outrage

Among the most contentious aspects is Section 77 of the Nigeria Tax Bill 2024, which outlines the allocation of value-added tax (VAT) revenue. Critics argue that the provision would unfairly benefit Lagos, Rivers, and Ogun states, leaving northern and other regions at a disadvantage.

Senator Ibrahim Gobir, a former representative of Sokoto East, accused the President of promoting regional bias. “Consumers in Nigeria are not only Yoruba or Lagosians; they are all over the nation. When I drink Pepsi in Abuja, I shouldn’t have to pay VAT to Lagos,” Gobir told Hobnob News. He added, “If this is the case, then for any food item brought from the North, the VAT on it should be paid to the North. This bill creates an impression of one section being superior to others.”

Gobir further warned that unless the “abnormalities” in the bills are corrected, they will be rejected outright. “We are not going to review them; we are going to dump them,” he asserted.

Democratic Principles Under Threat?

The NEF echoed these sentiments, emphasizing that Tinubu’s declaration undermines democratic principles by sidelining the National Assembly. Abdul-Azeez Suleiman, the forum’s spokesperson, cautioned against creating unnecessary political tension. “By pre-emptively declaring the bills as final, the President risks alienating lawmakers and undermining the legislative process,” Suleiman said.

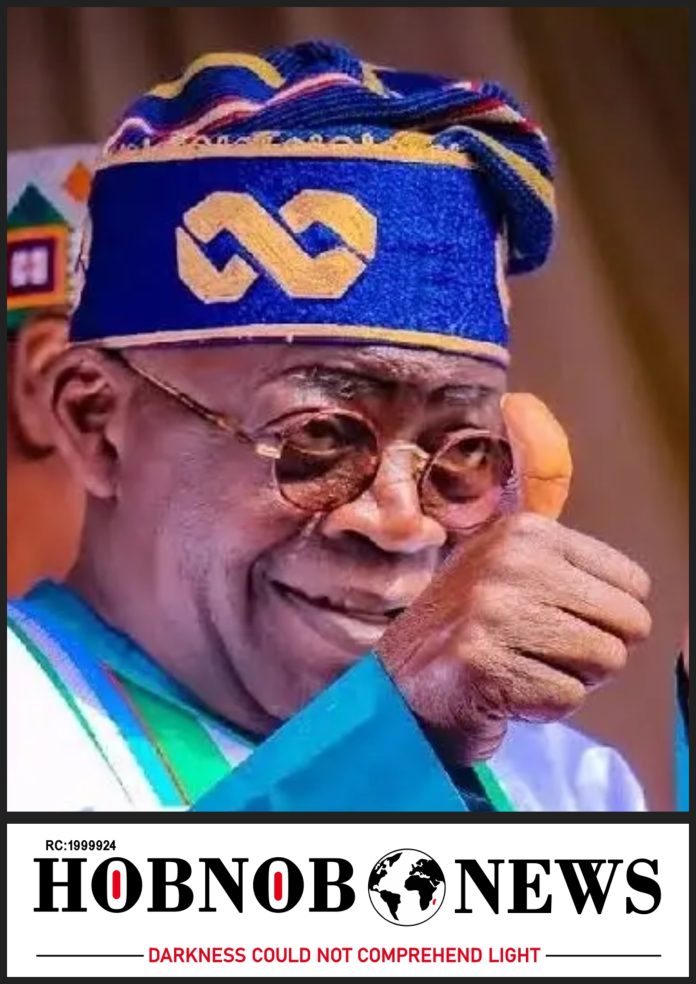

During his maiden media briefing in Lagos earlier this week, Tinubu defended the tax reforms, stating that they are necessary to eliminate outdated, colonial-based tax policies. “While these reforms may not be embraced by everyone, there is no turning back,” the President declared.

Calls for Legislative Independence

Senator Mohammed Onawo, representing Nasarawa South, also criticized Tinubu’s approach, urging the President to respect legislative independence. “If the President, who was once a legislator, dismisses the importance of parliamentary review, it sets a poor precedent. Bills should follow due process, allowing lawmakers to assess their merits and amend contentious areas,” Onawo said.

Onawo further noted that many legislators have not had the opportunity to thoroughly review the bills. “Most of the people commenting on these bills have only seen summaries. It is the legislature’s duty to identify and amend contentious areas to reflect the public’s opinion and ensure the bills serve the greater good,” he explained.

The League of Northern Democrats Weighs In

The League of Northern Democrats, while acknowledging the need for tax reforms, called on the President to adopt a more consultative approach. Umar Sani, a former spokesperson for ex-Vice President Namadi Sambo, highlighted the importance of addressing cultural and religious sensitivities.

“Tax reform is essential to fight corruption and increase revenue, but certain provisions, like inheritance tax, conflict with religious and cultural values. We’ve made our suggestions, and it’s important for the government to consider them,” Sani said. He added, “The President must avoid rigidity on issues that affect the general welfare of citizens. Flexibility and dialogue are key to achieving broader acceptance.”

The Proposed Reforms

The tax reform package includes four key bills:

- Nigeria Tax Bill 2024 – Aims to provide a comprehensive fiscal framework for taxation.

- Tax Administration Bill – Seeks to streamline the legal framework for taxation and reduce disputes.

- Nigeria Revenue Service Establishment Bill – Proposes replacing the Federal Inland Revenue Service with a modern Nigeria Revenue Service.

- Joint Revenue Board Establishment Bill – Creates a tax tribunal and ombudsman to enhance dispute resolution.

What’s Next?

As the tax reform debate heats up, lawmakers and stakeholders are urging the President to reconsider his stance. They argue that a more inclusive and consultative approach will ensure the reforms address the needs of all Nigerians, rather than favoring specific regions.

With mounting pressure from northern leaders and civic groups, Tinubu faces a critical test of his leadership and ability to foster unity in the country. Whether he will engage in meaningful dialogue or hold firm on his current position remains to be seen.