A recent financial audit report released by the Auditor-General of Osun State, Kolapo Idris, has uncovered a staggering accumulation of loans and borrowings by the Osun State Government, bringing the state’s total debt to over N336 billion.

The audit report provides a detailed analysis of the state’s fiscal strategies, revealing a heavy reliance on borrowed funds. Domestic debts include a salary bailout of N21.6 billion, restructured commercial bank loans of N73.9 billion, and a Federal Government intervention fund worth N18.4 billion.

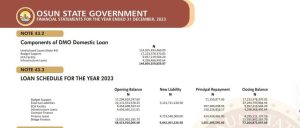

Furthermore, the state’s external debt stands at N78.5 billion, while additional liabilities managed by the Domestic Debt Management Office (DMO) total N144.6 billion. These include undisclosed loans of N114 billion, a budget support facility of N17.2 billion, an Excess Crude Account (ECA) facility of N9 billion, and infrastructure loans of N4.3 billion.

The audit report also highlights a significant shortfall in public debt charges for 2023, amounting to N16.73 billion, which is N3.12 billion less than the initially budgeted N19.85 billion. Domestic interest payments and principal payments also fell short of budgeted amounts.

In contrast, the state’s travel and transport expenses totalled N4.38 billion, reflecting a minor shortfall of N253.7 million compared to the estimated N4.63 billion.