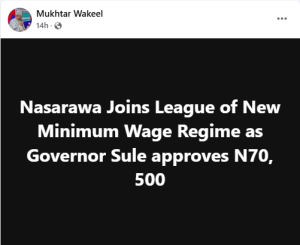

Veteran journalist Mukhtar Wakeel from Nasarawa State recently sparked discussions about financial management and lifestyle choices following the state government’s approval of a ₦70,500 minimum wage for workers.

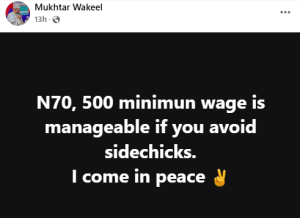

Wakeel suggested that this amount could sustain a family if unnecessary expenses, particularly “side chicks,” are avoided. “₦70,500 minimum wage is manageable if you avoid side chicks. I come in peace,” he remarked on Saturday.

His statement has stirred reactions, with some agreeing that disciplined spending can make the amount workable, while others argue that the wage remains insufficient given rising inflation and economic hardships.

This conversation highlights the broader debate over the adequacy of the new minimum wage across Nigeria, especially as the Nigerian Labour Congress (NLC) presses for full implementation in all states.

The approved minimum wage of ₦70,500 was signed into law by President Bola Tinubu in July 2024 to cushion workers against economic challenges. While over 30 states have adopted the new wage structure, compliance issues remain in Zamfara, Sokoto, Cross River, and Nasarawa. The NLC has set a December 1, 2024, deadline for all states to comply or face industrial action.

As Nigerians adjust to the updated minimum wage, discussions like Wakeel’s underline the importance of financial planning while emphasizing the need for governments to address inflation and improve living conditions for workers nationwide.