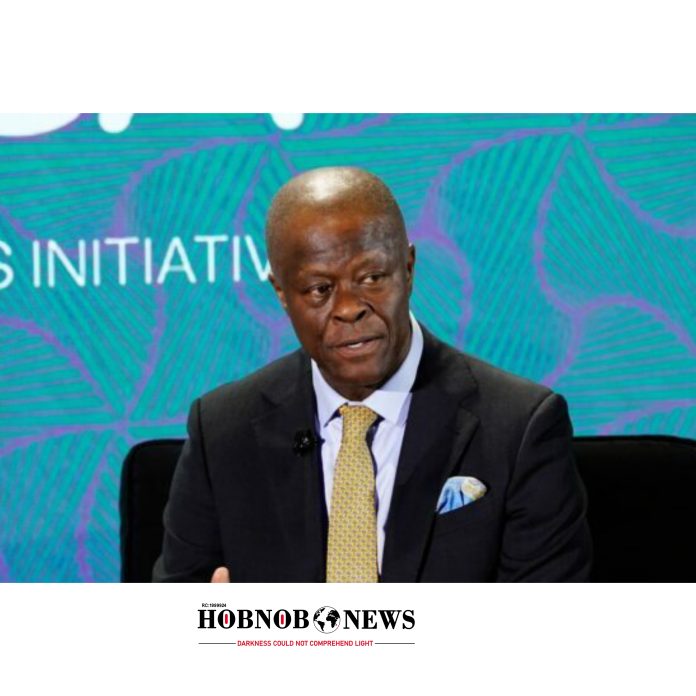

Minister of Finance, Wale Edun, addressed the National Economic Council (NEC) on Tuesday at the Presidential Villa, Abuja, outlining Nigeria’s unique inflation challenges and efforts toward economic stabilization. Unlike advanced economies, which have largely stabilized inflation around 2%, Nigeria’s inflation remains high due to factors such as dependence on imports and a sizable informal economy.

Edun highlighted the contrast, noting that “countries like the US and many in the Eurozone are seeing inflation levels close to their target of around 2% per annum,” with some, like Italy, experiencing rates even below 1%. He attributed this to what he described as a “soft landing” approach, balancing inflation control with sustained economic growth. Nigeria’s situation, however, differs significantly, with persistent high inflation, low growth, and challenging debt levels.

The Tinubu administration has implemented reforms aimed at addressing these structural challenges. One major step is the removal of subsidies on petroleum and foreign exchange, which Edun said previously cost Nigeria between $15 and $20 billion annually—around 5% of its GDP. Although necessary, this move has raised living costs, especially for low-income Nigerians. Nevertheless, Edun emphasized that the savings from subsidy removal are being reinvested into critical social and infrastructure projects.

One key initiative is requiring local refineries to pay for crude oil in Naira, reducing Nigeria’s dependency on volatile international markets and stabilizing domestic fuel prices. This change has reportedly added around N700 billion monthly to Nigeria’s Federation Account since October, funding national priorities.

The government has also launched various welfare programs to cushion the economic impact on Nigeria’s vulnerable populations. Among these are minimum wage increases, direct financial support to households registered on the government’s social register, and wage support for low-income workers. To date, these initiatives have reportedly reached about five million households, benefiting around 25 million people. Edun noted that these payments are processed biometrically to ensure accuracy and prevent fraud.

Additionally, the government has introduced a consumer credit scheme, providing affordable loans for essential goods and services. This program has distributed over N3.5 billion to 11,000 recipients, helping them acquire compressed natural gas (CNG) kits as a more cost-effective, eco-friendly fuel option.

The administration’s student loan program has also expanded, supporting over half a million students with N90 billion in loans for educational and living expenses. This initiative seeks to reduce the financial burden on students amid high inflation rates.

In addressing food inflation, the government has launched policies to make staple foods more affordable. Edun mentioned a duty-free import program for brown rice, allowing millers to sell processed rice at reduced prices. Additionally, efforts are being made to boost domestic crop production, especially for rice and wheat. The government plans to support 600,000 farmers in upcoming planting seasons with subsidies on essential farming inputs like fertilizers, herbicides, and seeds.

Recognizing the importance of small businesses in driving economic growth, the government has allocated close to N50 billion in grants for micro-enterprises, with 90% of these funds already distributed. Small and medium enterprises (SMEs) and large industries are also receiving loans at 9% interest to foster growth and job creation, with loan amounts capped at N1 billion to maintain manageable debt levels.

To further stabilize the economy, Edun announced a nine-month foreign exchange repatriation program beginning October 31. This initiative encourages Nigerians to deposit their offshore dollars into local banks without facing penalties or taxes, provided the funds comply with anti-money laundering laws. The program aims to strengthen foreign reserves, alleviate exchange rate pressures, and foster currency stability. Detailed guidelines, developed by the Ministry of Finance and the Central Bank, are expected soon.

Throughout his briefing, Edun reiterated the government’s commitment to addressing Nigeria’s economic challenges. “We are making strides in addressing the country’s long-standing economic vulnerabilities,” he stated, explaining that the administration’s policies are designed for both immediate relief and long-term resilience.

As inflation and economic pressures continue, the Tinubu administration faces significant expectations to stabilize the economy and ease the burden on Nigerians. Edun expressed optimism, stating that through a blend of subsidy reforms, targeted social programs, and innovative financial strategies, Nigeria can overcome its inflationary challenges and pave a path toward economic stability.