The Central Bank of Nigeria (CBN) has raised a cautionary flag concerning evolving borrowing trends in West African nations, highlighting a departure from the conventional reliance on loans from the Paris Club towards an increased dependency on non-Paris Club members and private lenders.

The West African Institute for Financial and Economic Management expressed concerns about Nigeria’s elevated risk of falling into debt distress, urging the government to focus on enhancing revenue generation.

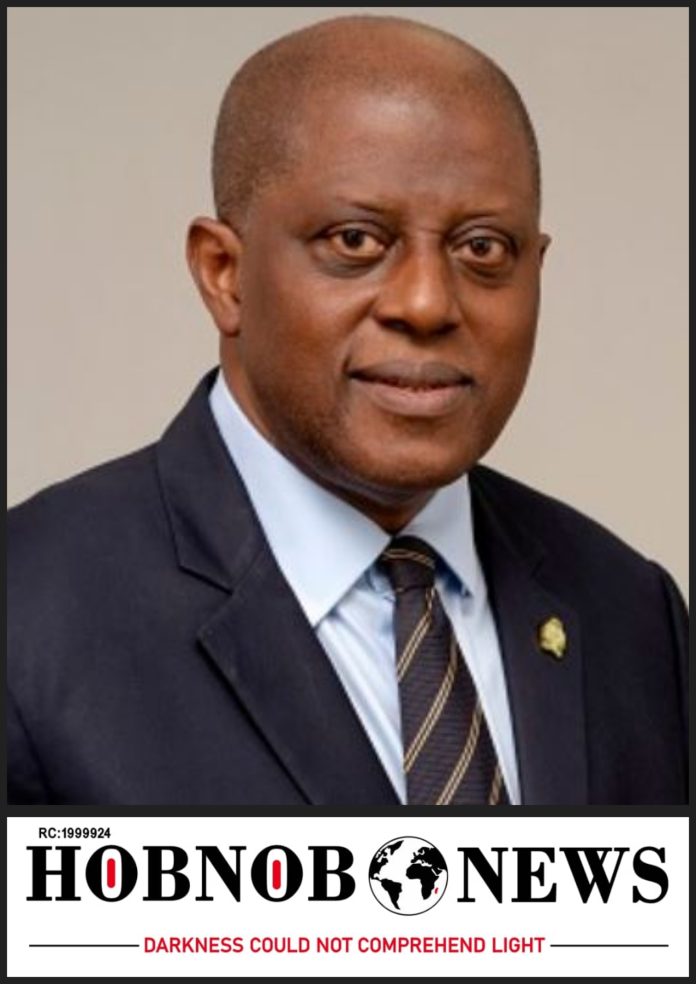

Governor Yemi Cardoso, representing the CBN at a joint World Bank/IMF/WAIFEM Regional Training, emphasized the significance of this shift, indicating potential complications in managing debt owed to these new lenders.

He underscored the serious implications for financial stability and economic recovery, particularly as recent events like the COVID-19 pandemic, geopolitical conflicts, and natural disasters strain countries’ finances, prompting diverse sources of loans.

Cardoso said, “Public debt dynamics are increasingly influenced by significant debt servicing obligations to non-Paris Club members and private lenders, including commercial banks and bond investors.

“This shift in the debt structure represents a critical evolution in the global financial framework, with profound ramifications for public debt management in our countries.”

Despite Nigeria’s moderate debt risk classification, the CBN urged the federal government to exercise caution, especially in addressing liquidity risks.

“Following the COVID-19 pandemic, along with other developments such as geopolitical conflicts and natural disasters, the financial strain on our sub-region has escalated, posing a threat to their macroeconomic and financial stability and prospects for faster recovery,” he said.

The warning stressed the importance of effective revenue mobilization to mitigate challenges to debt sustainability and economic stability in the face of changing borrowing landscapes.