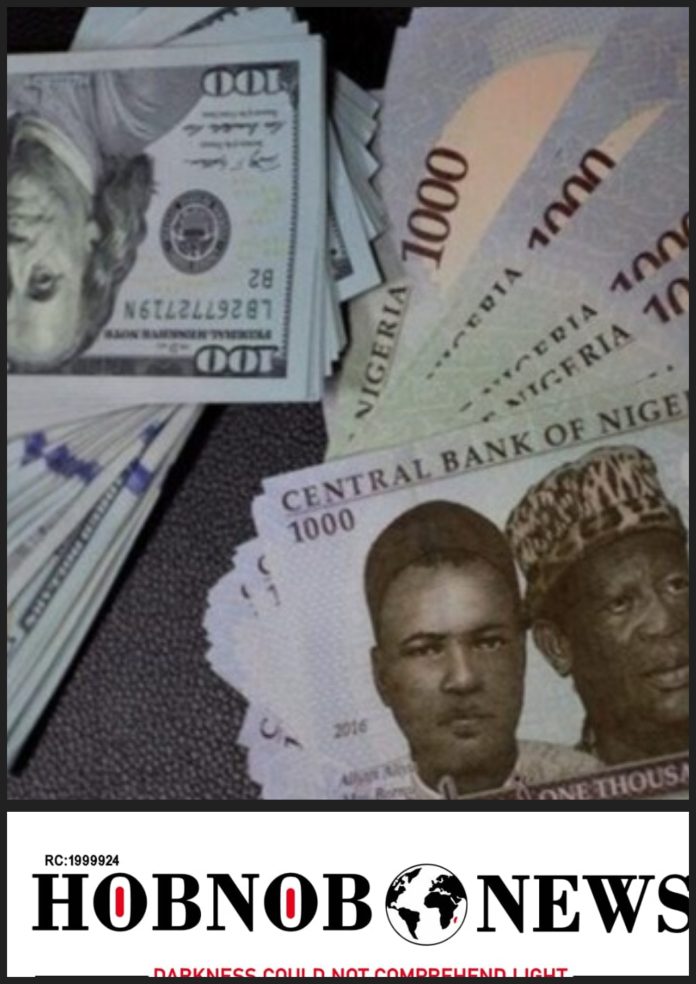

There was a substantial shift in the currency landscape as the US Dollar on Wednesday experienced a significant 6.45% decline against the Naira, plunging from N1,550 to N1,450 in the parallel market.

This notable fluctuation ensued in the wake of the Central Bank of Nigeria’s decisive move to elevate its benchmark interest rate, the Monetary Policy Rate (MPR), by a substantial 400 basis points, reaching 22.75%.

Despite the discernible reaction in the informal exchange arena, the official foreign exchange rate indicated a more modest 2.04% depreciation, with the dollar quoted at N1,615.94 on Tuesday in contrast to N1,582.94 on Monday.

These developments occurred in conjunction with broader policy adjustments made during the Monetary Policy Committee (MPC) meeting.

The asymmetric corridor underwent modification, the Cash Reserve Ratio experienced an uptick from 32.5% to 45.0%, while the Liquidity Ratio remained at 30%. Yemi Cardoso, the Governor of the Central Bank of Nigeria, who presided over the MPC, articulated confidence in the ongoing reforms within the foreign exchange market.

He underscored the committee’s consideration of various distortions in the market, particularly the activities of speculators putting upward pressure on the exchange rate, with potential implications for inflation.

The governor expressed conviction that the implemented reforms, including the unification of the foreign exchange market, promotion of a willing buyer-willing seller dynamic, and removal of limits on margins for International Money Transfer Operator (IMTO) remittances, would yield positive outcomes in the short to medium term.

In parallel developments, the Bureau De Change (BDC) operators, a significant component of the foreign exchange ecosystem, were reported to be awaiting their dollar allocations from the CBN.

This anticipation comes after the CBN approved a weekly allocation of $20,000 to each of the approximately 785 listed BDCs at a rate of N1,301 per dollar, as outlined in a circular published on Tuesday.

These BDCs are permitted to sell to end-users with a margin not exceeding one percent above the purchase rate from the CBN.

The intricate interplay of monetary policy adjustments, currency fluctuations, and market dynamics highlights the multifaceted nature of the challenges and strategies employed within Nigeria’s economic landscape.