Strong indications have emerged more Nigerians may relocate from the country in 2023 and beyond as the nation’s socio-economic conditions worsen, and hope remains bleak.

This came on the heels of the recent removal of fuel subsidy, further depreciation of the naira, impending increase in electricity tariff, and the introduction of Value Added Tax on diesel amid an already battered economy.

The Nigerian economy has been exposed to numerous economic shocks in recent times and this has led to a surge in the number of Nigerians leaving the shores of the country in search of greener pastures overseas.

Multiple travel agency officials confirmed to The PUNCH on Friday that ticket booking showed several Nigerians would leave the country during this summer.

According to them, several intending travelers are relocating to London, Canada and the United States of America via study route while others are leaving to take up new jobs in the Western countries.

The National Chairman of the National Association of Nigerian Travel Agents, Susan Akporiaye, confirmed to The PUNCH that there has been a massive increase in the number of Nigerians travelling outside the country lately.

According to her, most travel bookings have ranged from Nigerians looking to relocate for educational to professional reasons.

Susan said, “A lot of countries, especially Canada, have made it clear that they need more hands. There is a crisis in the UK, where they don’t have enough hands to take care of the elderly. So, they opened up that they want caregivers. So, there is a massive movement in that angle, for caregiving. So this has contributed to a large number of people who want to migrate.”

The Founder of Travels N Tours, Biola Abimbola, said more people were leaving Nigeria than ever before.

He said, “Yes. More people want to travel now because the state of the economy is bad and the youths are looking for where there are opportunities, especially the middle class. The problem is that more people are leaving than ever before.”

Relocation plans

One of the Nigerians seeking to relocate abroad, who spoke to The PUNCH, said, “Not having a job is what is motivating my Japa. I am leaving for a better chance of finding work.”

The lady, who only gave her name as Doyin because she didn’t want her name in print, stated that she was set to proceed to the United States later this month to find better work and improve her life.

She added, “The day I went for my visa interview, there were about a hundred people there.”

A customer care representative with Sterling Bank, Chiamaka Steven, who is set to move to the United Kingdom by the end of the year told The PUNCH that the decision to leave Nigeria was inspired by the high cost of living and a dwindling standard of living in recent times.

She said, “You don’t need to look very far. Look at inflation. Look at the high cost of living and the low standard of living.

“Also, even if they pay you N1m today, in the next ten years, they will employ another person who is younger than you to replace you. They know that your clock is ticking. So, it’s better I save what they are paying me, and use it to Japa instead of waiting for them to tell me that my services are no longer needed.”

Victor Thompson, an Uber driver who recently had his application for temporary residence in Canada approved, said the present cost of living crisis was a major factor that influenced his decision to leave Nigeria.

According to him, the e-hailing business has become unprofitable. He said, “I bought fuel N15,000 yesterday and it was just a half tank. Before the removal of fuel subsidy, I needed about N12,000 to N13,000 to fill my tank.

“I worked yesterday and made about N31,000 but the fuel finished and got to reserve. I had to go and buy another N15,000 fuel today. I have just closed from work. I made N20,000.

“This my Japa plan started before Covid in 2020, but I abandoned it. But with everything that is happening now, I started pursuing it more seriously, and thank God there’s headway now.”

A senior lecturer in a private university who pleaded to be quoted anonymously revealed to The PUNCH that he has relocated his family to the UK and would be joining them soon.

He said, “My family is no longer in this country. I took them out of the country last month. So, as we are speaking, I am planning to leave.

“The truth is that things are quite unbearable for people, and when things are unbearable, people will want to go to climes or environments where they can have a better life. My family is in the UK as we speak. I have a very big house here and I’m relocating into one small two-bedroom apartment in the UK. The tendency is that when people leave, they know that there is going to be better security, healthcare, and education.”

Poor economic growth

Data obtained from the National Bureau of Statistics and the Central Bank of Nigeria showed that Nigeria was struggling with poor economic growth.

The Gross Domestic Product growth has hovered below five per cent, The PUNCH has learnt.

The World Bank recently warned that Nigeria’s economic growth was too slow to address the challenge of extreme poverty in the country.

Meanwhile, the bank retained its economic growth forecast of 2.8% for Nigeria in 2023, citing challenges of high inflation, foreign exchange shortages, and shortages of banknotes caused by currency redesign.

The PUNCH also observed that the country has been battling with rising inflation, which has led to a decline in consumers’ purchasing power.

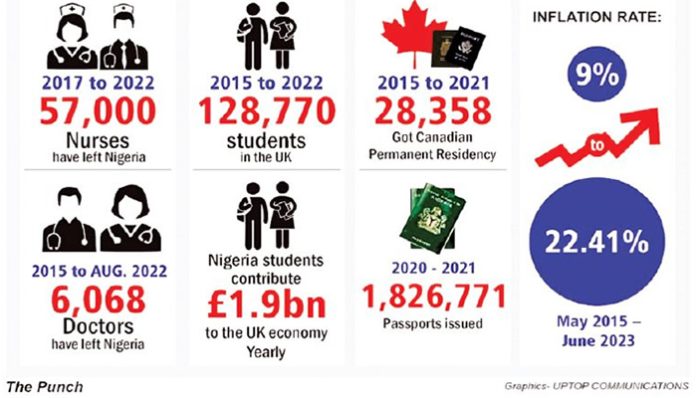

Data from the NBS put the inflation figure at 11.61 per cent in May 2018, but this has increased by 10.8 percentage points, hitting 22.41 per cent in May 2023, which was the most recent data.

In its December 2022 Nigeria Development Update, the World Bank said that inflation pushed five million Nigerians into poverty between January and October 2022.

During his presentation of the reports, the World Bank Lead Economist for Nigeria, Alex Sienaert, noted that the Nigerian minimum wage, which was worth N30,000 in 2019, could be valued at N19,355 today.

In the June 2023 Nigeria Development Update, the World Bank said that the accelerating inflation pushed an additional four million Nigerians into poverty in the first five months of 2023.

This means that between 2022 and 2023, not less than nine million Nigerians have been pushed into poverty as a result of inflation.

The NBS recently stated that 133 million Nigerians are multi-dimensionally poor. According to the World Bank, Nigeria’s GDP only grew by 1.1 per cent between 2015 and 2021 and it would take about a decade for Nigeria to return to the level of GDP per capita seen in 2014.

Amid the rising poverty, a number of Nigerians are still unemployed, according to available data.

The NBS put the unemployment figure at 23.13 per cent in Q3 2018, and by Q4 2020 (which was the most recent by the NBS), the unemployment rate was 33.28 per cent.

The NBS, despite stating that it would release an updated figure in May 2023 has failed to release any new unemployment figure since 2020.

New policies’ challenges

However, the new administration has introduced a number of policies, which have had a significant impact on many Nigerians.

Such policies include the removal of fuel subsidy and the unification of multiple exchange rates.

Since President Bola Tinubu affirmed the removal of fuel subsidy, the price of petrol has risen from less than N200 per litre to almost N500. Also, since the CBN adopted a more market-friendly foreign exchange regime, the naira has lost about 40 per cent of its value, falling from about N463/dollar to N750/dollar.

The increase in the price of petrol has boomeranged into an increase in the cost of food, other goods and services. Since Nigeria is an import-dependent country, the devaluation of the naira has led to further hardship for many Nigerians.

The World Bank has disclosed that 7.1 million Nigerians would become poor because of the removal of subsidy if the government doesn’t provide palliative.

According to the bank, this would take the total number of poor Nigerians in the country to 100.9 million. It noted that many households would lose N5,7000 per month from their income.

World Bank said, “Petrol prices appear to have almost tripled following the subsidy removal. The poor and economically insecure households, who directly purchase and use petrol as well as those that indirectly consume petrol, are adversely affected by the price increase.”

It added, “Among the poor and economically insecure, 38 percent own a motorcycle and 23 percent own a generator that depends on petrol. Many more use petrol-dependent transportation. The poor and economically insecure households will face an equivalent income loss of N5,700 per month, and without compensation, an additional 7.1 million people will be pushed into poverty.”

The hardships have fuelled a situation where more Nigerians are planning to leave in 2023 and beyond as inflation rose to 22.41 per cent as of May 2023, a 17-year high.

This is coming as purchasing power decreases, and a cloud of uncertainty hovers over the Nigerian economy.

Studies reveal

A recent survey by the Africa Polling Institute revealed that 69 per cent of Nigerians would relocate if given the opportunity. A 2023 report by Phillips Consulting disclosed that over 52 per cent of professionals in Nigeria are contemplating leaving their current jobs for opportunities overseas within the next year.

It stated that this is due to market uncertainty, inflation, digitisation acceleration, changes in consumer behaviour, increased operational expenses, and complexity.

According to SAP research, 80 per cent of Nigerian companies expect to experience a skills gap in the next year. Rising unemployment, which is predicted to hit 40.6 per cent in 2023 according to KPMG will be a large contributor to this.

Medical professionals leave

The President of the National Association of Nigeria Nurses and Midwives, Michael Nnachi, recently told The PUNCH that over 57,000 nurses migrated from Nigeria between 2017 to 2022.

He noted that this had led to a dire outlook for health professionals. He said, “But if you’re looking at the statistics of Nigeria, it is one nurse to 1,660 patients, looking at the population of Nigeria.”

The PUNCH report recently stated that 6,068 medical doctors moved to the United Kingdom between 2015 and 2022.

The report disclosed that +the number of migrating doctors increased by 375.1a per cent from 233 in 2015 to 1,107 in 2022. Data obtained from the Higher Education Statistics Agency of the UK by The PUNCH, disclosed that 128,770 Nigerian students enrolled in universities in the United Kingdom between 2015 to 2022.

In 2022, the number of dependents (i.e. spouse/family relations of migrating students) increased to 66,796 from 27,137 in 2021. Yearly, these Nigerian students and their dependants in the United Kingdom contribute about £1.9bn to the UK economy, according to an analysis by SBM Intelligence.

Par another The PUNCH report, about 28,358 Nigerians received invitations to apply for Canadian permanent residency from 2015 to 2021. The Nigeria Immigration Service recently announced that it issued 1.83 million passports between 2020 and 2021.

According to the Executive Director of Adopt A Goal Initiative, Mr Ariyo-Dare Atoye, the rising number of Nigerians obtaining passports was connected to the high emigration rate caused by the harsh economic realities and security challenges in the country.

He told The PUNCH in a recent interview, “Numbers don’t lie.”

He added, “Check the statistics of the Nigerian Medical Association and see how many doctors have left in the last two years.”

Banking sector suffers

Every sector of the economy has been hit by the Japa wave, and one of the most glaring effects of this wave has been the increasing number of failed electronic transactions in the banking sector. A massive brain drain in this industry, particularly in IT departments, has frustrated the digital plans of many banks.

A Bloomberg report, quoted the Chief Executive Officer of Sterling Bank Plc, Abubakar Suleiman, “So many of our very experienced talents especially in the area of software engineering are either leaving the industry or leaving the country.”

An IT professional in one of the tier-one banks confirmed to The PUNCH that banks are losing their best hands to the Japa movement.

He said, “People just want to leave because of the economic situation of the country, The banks are trying in terms of increasing salaries to keep staff. Basically, every September and January, we have people leaving in droves. Last January, my department, the technology unit, lost about 20 of our best hands. It is much.”

Recently, the Country Manager of Tek Experts Nigeria, Olugbolahan Olusanya, disclosed that many banks are now relying on outsourcing talents to fulfill their IT needs.

The Co-founder and Chief Operating Officer of truQ, Foluso Ojo, noted that it is easier for tech talents to get global opportunities than others.

She told The PUNCH, “Since the inception of the Japa boom, it is easier for tech talents to get global opportunities than any other skill set.”

She added, “The tech sector is not left out of the negative impact of people leaving, what we really need to do is create opportunities for more people to be able to learn, create more STEM courses for people to learn.”

She explained that the people leaving are also contributing to remittances and improving the country in their way.

Experts react

According to an economist at the Olabisi Onabanjo University, Prof. Sheriffdeen Tella, the purchasing power of the average Nigerian household has been negatively impacted by the recent economic reforms because no buffers have been provided to mitigate the consequences of the decisions.

Tella stated that given the harsh economic environment in the country, the proposal to increase electricity tariffs as well as introduce new taxes was ill-timed and would consequently impoverish more Nigerians.

He told The PUNCH, “The fact is that the government has to think of what to do to make sure that the effect is not prolonged.

“They should start thinking of what to do immediately and in the long run. If we say the government should start giving people more money, if there is no production, the money will worsen inflation.

“We pay a lot of taxes in this country. I don’t believe that the government should be looking for ways to tax the common people now. It is not the proper thing to do.”

He warned that if deliberate and intentional efforts are not taken to address the economic hardship in the country, more Nigerians would be motivated to seek greener pastures outside the shores of the country.

On his part, the Head of Economics Department at the Pan-Atlantic University, Lagos, associate Professor Olalekan Aworinde, noted that while the recent economic reforms of the government have been a necessary evil that could benefit the economy in the long run, measures ought to have been put in place to contain the hardship that would follow in the immediate aftermath of these reforms.

According to him, with more people being pushed into the poverty net, there is a high likelihood of an increase in unemployment which could further worsen social vices such as armed robbery and other forms of organised crime.

He said, “Of course, the situation will affect the expenditure pattern of Nigerians. If you look at someone who is a fixed-income earner who was earning the same salary before all these policies are made. There are no palliatives. The cost of living is on the increase. The implication of this is that it will drive down their consumption expenditure.

“Once their income does not increase and the prices of goods and services are increasing, it means that they will have to reduce their consumption to manage the little resources at their disposal. We are going to see a situation whereby the level of consumption expenditure, for the consumers and organisations as well. You’ll find out that the expenditure for the firms, which is investment expenditure, is also going to reduce.”

The Chief Executive Officer of the Centre for the Promotion of Private Enterprise, Muda Yusuf, lamented the hardship that Nigerians are currently facing due to the fallout of the removal of fuel subsidy.

He urged the government to reverse some of its newly introduced tax measures as this would further exacerbate the hardship of the citizens.

He said, “They should reverse this new vehicle tax, this proof of ownership tax that they announced because these things can even provoke the citizens.

“They also said they want to start taxing the informal sector. All these things should be put on hold because there is only so much sacrifice that the citizens can make at a time; because whether you like it or not, this fuel subsidy situation is really biting hard. It is affecting a lot of people, especially the vulnerable people.”

Recently, a member of the House, Philip Agbese, moved a motion titled, ‘Need to Declare Emigration of Young Nigerians Abroad A.K.A Japa Syndrome a National Emergency,’ and urged the government to “convene a national summit with key stakeholders to effectively address the ‘Japa Syndrome.’

He said, “The House is concerned that the growing statistics of young Nigerians leaving Nigeria… portends a grave danger for our nation in many ways from economic to intellectual and social aspects.”

The house has since voted against the motion.